In the ever-evolving world of Forex trading, having access to timely and accurate market signals can significantly enhance a trader’s success. Forex signals trading software has emerged as a vital tool for both novice and experienced traders, providing insights that can help make informed trading decisions. This review delves into what Forex signals software entails, its key features, advantages, potential drawbacks, and overall effectiveness.

What Are Forex Signals?

Forex signals are trade suggestions that indicate when to enter or exit a trade, usually based on technical analysis, market sentiment, or economic indicators. These signals can be generated by professional traders, algorithms, or trading software. Forex signals trading software aggregates and analyzes market data to provide users with actionable insights, making it easier to navigate the complexities of the Forex market.

Key Features of Forex Signals Trading Software

Real-Time Alerts: One of the primary functions of Forex signals software is to provide real-time alerts when trading opportunities arise. These alerts can be delivered through various channels, including email, SMS, or in-app notifications, ensuring that traders can act quickly on potential trades.

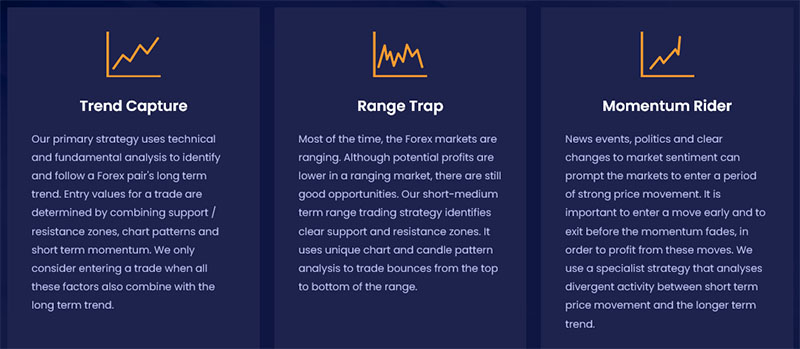

Technical Analysis Tools: Most Forex signals software comes equipped with technical analysis tools, allowing users to evaluate market trends, support and resistance levels, and various technical indicators. This feature helps traders validate the signals before acting on them.

Customizable Settings: Traders can often customize the software to align with their trading strategies and risk tolerance. This flexibility allows users to set parameters such as preferred currency pairs, risk levels, and the types of signals they want to receive.

Backtesting Capabilities: Many Forex signals platforms allow users to backtest strategies against historical data. This feature is crucial for assessing the effectiveness of a signal-generating method before implementing it in real-time trading.

Performance Tracking: A good Forex signals software will provide performance analytics, allowing users to track the success rate of the signals provided. This feedback helps traders refine their strategies and make data-driven decisions.

User-Friendly Interface: For traders at any level, an intuitive and easy-to-navigate interface is essential. Many Forex signals software options prioritize user experience, making it accessible for beginners while still offering advanced features for experienced traders.

Advantages of Forex Signals Trading Software

Time Efficiency: Forex trading can be time-consuming, requiring constant market monitoring. Signals software helps streamline the process, allowing traders to receive alerts without having to sit in front of their screens for hours.

Reduced Emotional Trading: By relying on data-driven signals, traders can reduce the influence of emotions on their trading decisions. This objectivity can lead to more consistent results and fewer impulsive trades.

Accessibility for Beginners: New traders may find it challenging to analyze the market effectively. Forex signals software simplifies this process, providing them with the insights needed to make informed decisions without requiring extensive market knowledge.

Diverse Strategies: Many platforms offer a variety of trading strategies, allowing users to choose signals that align with their risk tolerance and trading style. This diversity enables traders to experiment with different approaches and find what works best for them.

Risk Management: Effective Forex signals software often includes risk management tools, helping traders set stop-loss and take-profit orders automatically. This feature is crucial for protecting capital and minimizing losses.

Potential Drawbacks

Over-Reliance on Signals: While Forex signals software can provide valuable insights, relying solely on these signals without conducting personal analysis can be detrimental. Traders should strive to combine signals with their own research to develop a well-rounded approach.

Quality Variability: Not all Forex signals software is created equal. The quality and accuracy of signals can vary significantly between platforms. Traders must do thorough research and consider user reviews to select a reputable provider.

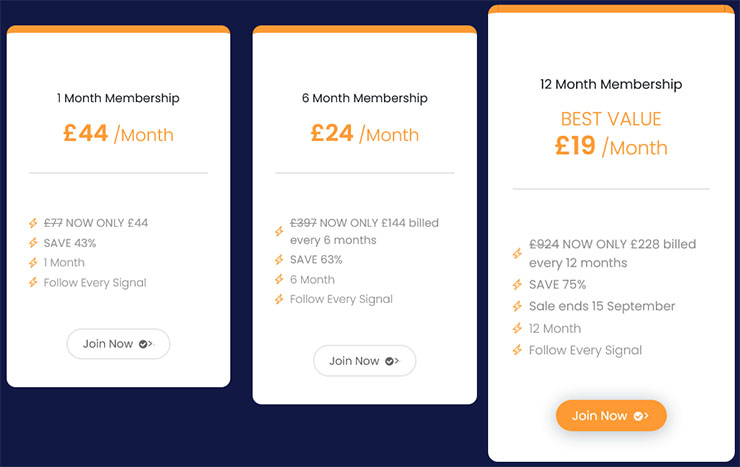

Subscription Costs: Many high-quality Forex signals platforms require a subscription fee. While some may offer free trials or basic services, advanced features often come at a cost, which can be a barrier for some traders.

Market Volatility: The Forex market is known for its volatility, and signals that may have been accurate at one moment can become irrelevant in the face of sudden market shifts. Traders must remain aware of broader economic factors that could affect their trades.

Learning Curve: Even with Forex signals software, new traders may face a learning curve. Understanding how to interpret signals, set parameters, and apply risk management strategies is crucial for success.

Conclusion

Forex signals trading software is an invaluable tool for traders seeking to enhance their trading strategies and improve their decision-making processes. With features like real-time alerts, technical analysis tools, and customizable settings, these platforms can significantly streamline the trading experience.

While there are many advantages to using Forex signals software, including time efficiency and reduced emotional trading, it’s essential for users to remain vigilant and not become overly reliant on the signals provided. A successful trading strategy should integrate signals with personal analysis and risk management practices.

Ultimately, the effectiveness of Forex signals software hinges on the trader’s ability to leverage the insights provided while continuously refining their skills and knowledge. By combining reliable software with a solid understanding of the market, traders can enhance their chances of achieving consistent profits in the dynamic world of Forex trading.